Money Legos is a DeFi buzzword that’s being thrown around a lot these days.

I just love the term money legos. It brings such a fun twist to the boring world of finance. Cryptocurrency and DeFi have brought in plenty of action and excitement into investing and making money. The lines are getting blurred between investing, gambling and gaming.

Investing in cryptocurrency feels like this one big strategy game anyway. When we talk about money legos, it feels even more like child play.

Seriously, are we really talking about the toy building blocks – Lego?

Yes indeed, we are! But don’t worry, it’s just a comparison to how lego functions as versatile building blocks.

So what does DeFi have in common with Lego?

- What are Money Legos?

- An Interesting Money Legos Example

- Another Fun Story: What’s DeFi Composability?

- The Money Legos Example in Detail

- Closing Thoughts

What are Money Legos?

Well, you know how Lego blocks are used to build stuff. If you have some lego pieces with you, you can build a variety of stuff using those pieces. You can also take them apart and build again to create something entirely new.

In DeFi, you can stack together various protocols, of your choosing, as if they were lego blocks. And you can later take them apart too. Then rebuild into a different stack using some of the previous blocks and maybe adding a few new ones. The Blockchains and DeFi protocols that you are stacking to form investments – are called money legos.

An Interesting Money Legos Example

This explanation is for crypto beginners, if you understand the basics, then you can jump to the next section. But I suggest you read it, it’s an interesting story.

Blockchains like Ethereum is like landscape or ecosystem on which the remaining applications (protocols) are built. Bitcoin, Binance, etc are some of the other blockchains. You can consider them as other countries on this landscape. Now on the Ethereum Landscape, you have structures (apps/protocols) built on this ground. They can all connect and communicate with each other.

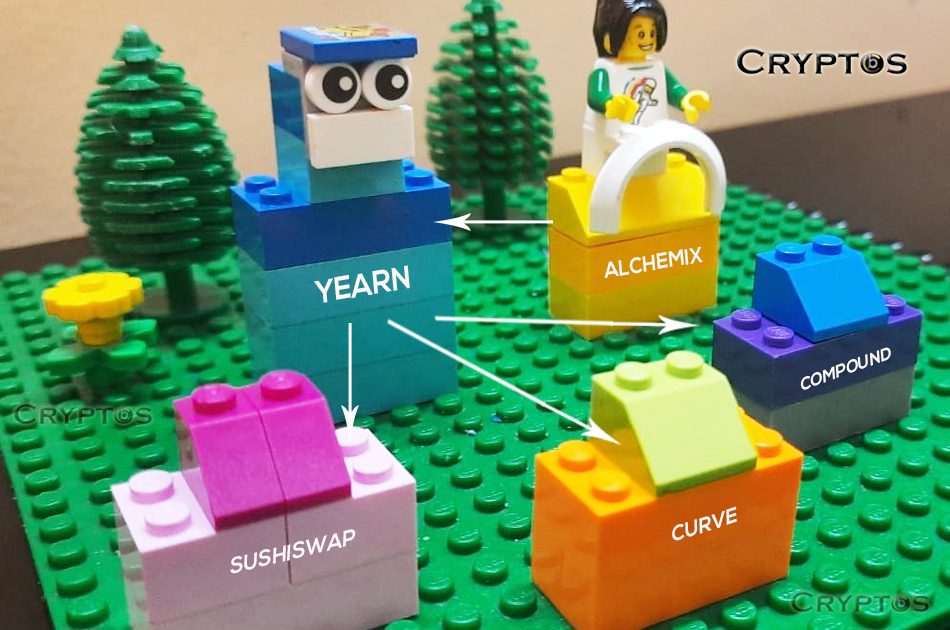

In the below image, I have depicted the green lego base as the Ethereum platform on which apps such as Compound, Curve, and Sushiswap are built. For the purpose of this article, you can compare these structures to banks in which you deposit your funds to grow your investments.

Another structure on this same landscape is an application called Yearn Finance – which can be considered an investment management company that handles your funds for you. Instead of having to personally decide where you should put your funds, you just hand it over to this fund manager. Yearn puts your cryptocurrency (funds) into the various ‘banks’ on this landscape to get you the best profits.

Now comes another structure built on this same landscape – Alchemix. This chap offers you instant loans using your Yearn fund as collateral. How that works is a whole different story, but this should give you some idea about how the ‘money legos’ connect to each other to build up a stunning financial ecosystem. I have discussed all these protocols in detail, later in the article.

And yeah! I did sit and build this Ethereum Lego landscape just for you! After writing the article, I felt the article was still too complex for beginners who may still be confused about what blockchains and protocols are. So I went to play around with some Lego. We are a cryptocurrency kindergarten, we’ll help you take those baby steps till you are ready to race.

Now let’s get back to business.

Another Fun Story: What’s DeFi Composability?

The next keyword you need to learn is ‘composability’.

Composability refers to the interoperability of DeFi protocols – how different protocols connect and interact with each other. As these protocols connect with each other (like lego blocks) and interact, they give rise to innovative and creative financial products or services.

This is possible because anyone can use DeFi protocols since they are open-source and permissionless.

Let me help you understand the interoperability of DeFi protocols (composability) using an example of social media platforms. Why should we have to register and join each and every social media platform separately in order to be able to use them – Facebook, Twitter, Instagram, TikTok, Pinterest, Snapchat… the list is endless.

Imagine sending a Tweet on Facebook or an Instagram post on TikTok. Sure, you can put an image of your tweet on Facebook, but here I am talking about tweeting from Twitter directly to Facebook – interoperability. This would have been possible if things were open instead of being closed off.

Well, as of now, such a thing is impossible. Facebook, Twitter and every other social media platform are competing against each other, closely guarding their user base and encouraging us to invite more friends to join their platform.

But did you know there was a time when Instagram pics were natively shared on Twitter and Facebook allowed you to play games like Farmville with your friends and share these game moments on Twitter. A global content feed with interoperability was indeed an amazing innovation.

But then Facebook shut off their Application Programming Interface (API) that allowed these applications to interact with each other. Why? It seems that a captive user base in their closed-circuit offered them more revenue.

If these social media platforms were decentralized, then they would have had interoperability – you could have mixed and matched them as you please, sending tweets to Instagram, and what not!

This is where the beauty of DeFi lies. You can mix and match various Dapps (decentralized applications) to create a brand new financial product. How about instant loans that repay themselves? Really?… Let’s find out!

The Money Legos Example in Detail

Remember our Ethereum landscape and the structures on it. Keep in mind that there are complex permutations and combinations for combining various money legos and building innovative and complex financial products. Let’s get into that example with a little more detail.

The money Lego pieces in our description:

- Ethereum blockchain

- Yearn Finance

- Curve

- Sushiswap

- Compound

- Alchemix

The Ethereum blockchain can be considered as the foundational lego block on which the remaining building blocks are stacked.

Yearn. Finance is our next lego block. It is a protocol that’s built on the Ethereum blockchain. It provides its users with access to the highest yields for their crypto assets. Users need to deposit their cryptocurrency into Yearn vaults to earn yields. Yearn. Finance was launched by Andre Cronje in July 2020. Its technology can be compared to a robot that’s always on the lookout for the best DeFi yields on Ethereum. YFI, the governance token of Yearn.finance shot from $3 to $30,000.

Yearn takes the crypto assets parked in their vaults and puts them into other high-yielding DeFi protocols. This includes liquidity pools of Curve or Sushiswap and lending protocols such as Compound. So Curve, Sushiswap, and Compound are money lego pieces that are connected to Yearn.

Now for another lego piece on top of all these – Alchemix.

Remember we mentioned earlier about those instant loans that repay themselves… This is indeed what’s called an innovative, hybrid DeFi application. Alchemix uses Yearn Finance as its building block.

You can put some crypto assets into Alchemix, which in turn puts it into Yearn for earning yield. You can take a loan from Alchemix against your capital (your crypto assets) as collateral. The best part is that you don’t have to pay off this loan. Instead, Alchemix takes the yield (profits) from Yearn to cover both the principal and the interest on your loan.

Closing Thoughts

I’m sure by now you have some understanding of how money legos work in DeFi.

The simplest examples include staking crypto tokens and using them as collateral to take loans. Another good example is how we add to liquidity pools on a DEX and use those LP tokens for farming and then take those rewards and further stake them. We are basically using the same underlying asset to create multiplicative yield.

It is widely acknowledged that there is a fine line between genius and insanity. As you can imagine, it takes insanely smart developers to come up with DeFi ideas such as the Alchemix – a concept that toppled the rules of financial gravity. More and more innovative protocols seem to be mushrooming over various blockchains from Ethereum to the Binance Smart Chain.

Traditional banking seems poised on the brink of an apocalypse against the power of DeFi money legos. Change can seem scary, but we all need to update ourselves and change with the times. The risks may seem great, but they can yield unbelievable results!